Large turboprop aircraft recovery: true or false?

Angus von Schoenberg, Industry Officer at TrueNoord examines why the recovery of turboprops lags behind single-aisle aircraft and the nuances impacting the resurgence of these aircraft in different markets.

Geographical variances in recovery

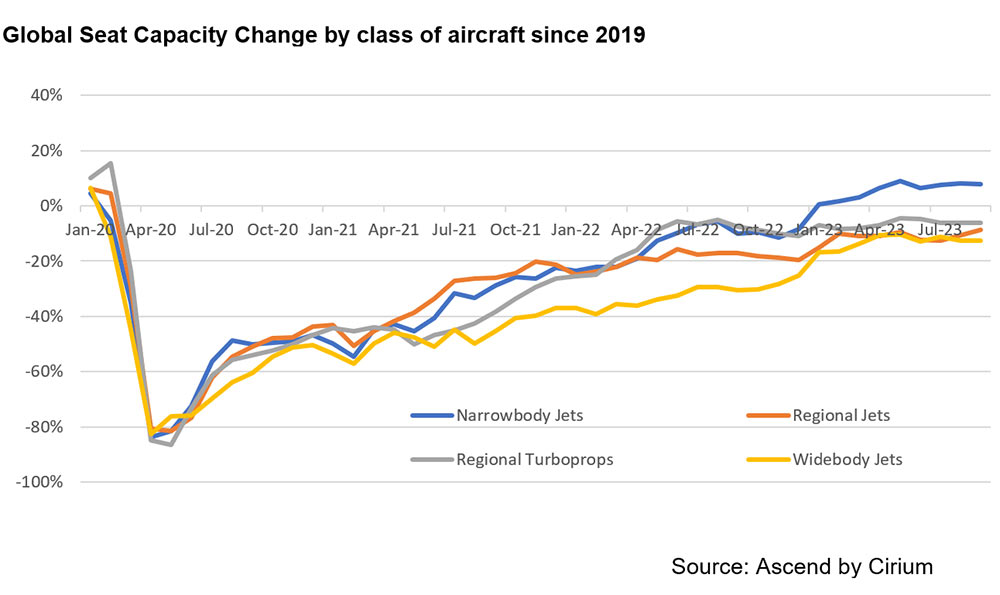

Having recovered more quickly or at a similar pace to other classes of aircraft in the post-pandemic period, it now appears that since mid-2022, turboprops, along with regional jets, are lagging behind single-aisle aircraft and have still not reached pre-pandemic levels.

The chart below indicates that turboprop recovery stagnated in 2022 and has only begun to pick up slowly during 2023, while narrow and wide-body capacity both caught up with, or surpassed, turboprops and regional jets. But does this differ according to geographical region?

Of the main markets, APAC has shown the strongest recovery reaching near 2019 levels. As the world’s largest market for current generation large turboprops up to 90 seats, this should not come as a surprise as in this region such aircraft provide connectivity where alternative modes of transport either don’t exist or are too slow. Once COVID restrictions were lifted services needed to be restored. The same applies to Latin America and the much smaller African market where capacity now exceeds 2019 levels.

By contrast the mature markets of Europe and North America are still down by over 20 per cent compared to 2019 levels. So, is this difference driven by structurally lower demand, or supply factors?

Challenges and factors impacting supply and demand

Given that in both Europe and North America (mainly Canada and North-western USA including Alaska) turboprops provide essential connectivity you would expect demand to be reasonably stable. In addition, the drive for greater sustainability should boost demand for turboprop connectivity as their fuel-burn and associated emissions are substantially less than similar capacity jets. If this is the case, a lack of supply must be the principal cause.

The fortunes of both ATR and De Havilland aircraft provide some answers. In both North American and European markets, some carriers have (or plan to) shed some or all their Dash 8-400 fleets. In Europe this process was accelerated by the pandemic with the demise of Flybe and LGW’s Eurowings operation, plus the decision by Austrian, airBaltic and LOT to phase out the type. The remaining operators are not materially growing their fleets to compensate, and new airlines like SkyAlps are only absorbing small numbers. In North America, Horizon’s disposal process is almost complete, and WestJet is seeking to reduce its relatively young fleet.

By contrast the ATR 72 fleet is much closer to full capacity recovery in Europe especially its newest ATR 72-600 variant. This is supported by storage and availability data that shows inactive ATR levels at or below pre-COVID levels. The main reason why some aircraft remain grounded relates to either a lack of MRO capacity to restore their airworthiness, or the uneconomic costs of doing so. This also means that ATRs could not replace much of the lost Dash 8-400 capacity even if operators wanted to. For example, much of the former Flybe network has not been replaced beyond a few key routes now operated by carriers such as Loganair. In North America, the ATR footprint is small and could therefore not fill in gaps vacated by the Dash 8.

In the broader regional aircraft market including regional jets, the lack of sufficient crews to enable recovery has been a major concern in recent times. This has been especially acute in North America where not only did crews leave the industry during the pandemic, but also those that remained have often been recruited to fly larger aircraft at higher salaries, thereby compounding the shortage. Whilst this has also been a concern in Europe, recent evidence suggests that this shortage may be beginning to ease.

Global seat capacity change by class of aircraft since 2019 However, staff shortages are not confined to crews. As Conor McCarthy, Executive Chairman of Emerald Airlines recently pointed out [at ISTAT EMEA in London], the availability of qualified engineers is now a bigger problem than pilots. This is because training qualified engineers takes far longer than crews and means that a balanced level of supply and demand for such skills will take far longer to restore. Along with extensively reported supply-chain driven lead time delays at OEMs and parts manufacturers, this limits the ability to both maintain and grow the turboprop fleet in Europe and elsewhere.

Conclusions and consequences for the large turboprop market

At a global level the turboprop market has still not recovered to prepandemic levels, yet many operators report load factors at all-time highs. This does suggest that other factors are inhibiting balanced supply and demand. No single reason in isolation can explain this imbalance but a combination of Dash 8-400 retirement, the lack of sufficient alternatives, and the challenges of returning turboprops to service add up to a credible explanation. The fact that used ATR 72 lease rates and values have recovered to 2019 levels and beyond further supports the thesis of tight supply. Consequently, the availability of Dash 8-400s is now also beginning to shrink, so lease rates and values have stabilised as the type finds new markets and applications to which it is well suited, including as highly capable fire-fighting aircraft.

For more information on the topic, download TrueNoord’s Turboprop Market Report 2023

Download the full article as PDF

Download the full article as PDF

Article courtesy of Regional International: https://www.eraa.org/publications/regional-international

13 December 2023