The shifting dynamics of regional aviation in Europe

Aviation in Europe is facing significant challenges. Despite this, regional airlines are adapting through fleet adjustments, lease extensions and ACMI support. Michael Adams, Sales Director Europe – Executive Director TrueNoord Services Ireland, explores the key trends shaping the sector’s resilience and evolution.

If you operate or lease regional aircraft, EUROCONTROL’s European Aviation Overview 2024, published this January, on initial observation may have given you cause for concern about the future of regional aviation in Europe.

According to EUROCONTROL’s market segment breakdown of average weekly departures, regional flights saw a modest 2% increase from the previous year. However, compared to 2019, the average number of weekly regional flights has dropped by 19%.

EUROCONTROL defines ‘regional’ as commercial flights operated by aircraft with 19–120 seats and its own explanation for this decline is “increased ticket prices, train/bus competition, government initiatives and environmental campaigns”.

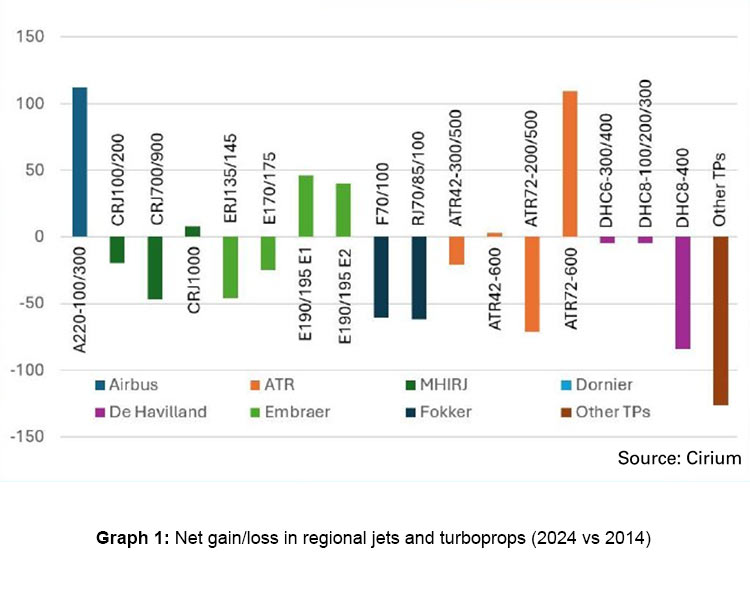

If the past five years have seen such a decline, what about the last decade? Between 2014 and 2024, the total number of regional aircraft in Europe has fallen by just over 23%, with turboprops experiencing the steepest reductions.

However, a closer look at the decade’s gains and losses by aircraft type reveals a clear trend – older, smaller regional jets and turboprops have been replaced by newer, larger aircraft.

Given this replacement, the total number of seats offered on inservice regional aircraft in 2024 is only 4.1% down compared to 2014. The average number of seats on a regional jet has increased

by just under 25% to 111 seats and 8% to 60 seats for turboprops.

Other market dynamics in regional aviation in Europe

Apart from the shift to larger regional aircraft, other dynamics in Europe include lease extensions and aircraft, crew, maintenance and insurance (ACMI) support moving gradually towards capacity purchase agreements like those in the United States (US).

There are several factors leading to more European regional airlines extending leases. Not least the fact that an Embraer E1 is not an old technology aircraft but a highly reliable 21st century

aircraft and, most importantly for many, an aircraft type with a mature engine. Several European E1 operators have extended leases to the end of this decade. They are investing in cabin upgrades, including in some cases, increased seating capacity by taking advantage of new slimline seats which are half the weight of those they are replacing.

The maturity of the CF34 engine on the E1 is in stark contrast to the issues plaguing the geared turbo fan (GTF) on both the A220 and E2. I am sure that several regional airline boards found it an easy decision to extend leases on E1s to allow the GTF engine to mature before committing to re-fleeting with a next generation aircraft.

More on the effects of supply constraints later, but first I would like to highlight its consequences in relation to ACMI support in regional aviation.

Observers of aviation in Europe will have noted two contrasting regional aircraft operational models at many of the major airlines. The first is the ‘in-house’ model, as is the case with Air France HOP! and KLM Cityhopper routes. The other is where we see a major airline outsourcing to an external provider, for example SAS with CityJet and Iberia with Air Nostrum. There are of course variations to these models as well.

Even with in-house operations, we also see major airlines seeking ACMI support to fill capacity shortages because of supply chain and GTF issues. One such example is KLM’s contracts with German

Airways and Eastern Airways to supplement their own operations with E1s. These are interesting times for European regional aircraft ACMI operators with consolidation (the creation of SARA – the

Strategic Alliance of Regional Airlines Limited – by Air Nostrum and CityJet) and the demise of one provider (Xfly), despite increased demand for ACMI services. The current level of demand has led at least one ACMI operator to decline short-term (summer season only) requests, insisting that if they are required then a longer-term commitment from the major airline needs to be agreed. Could we see more such demands from ACMI operators in Europe and therefore movement towards US style capacity purchase arrangements?

However, there are also challenges with the aircraft that the ACMI providers operate, and this is where longer term commitments will be critical. Several of the European regional operators fly out-of-production aircraft, for example CRJ90/1000 and Dash8 300/400s. As such, at least one such carrier has highlighted that they will need a longterm commitment from their customer before they themselves can commit to significant investment in a newer aircraft type. Whether it’s the aircraft itself, either through purchase or lease commitments, or aircraft technical support (manuals, tooling and parts), flight crew and engineer training.

Regional aircraft lease rates – perception versus reality

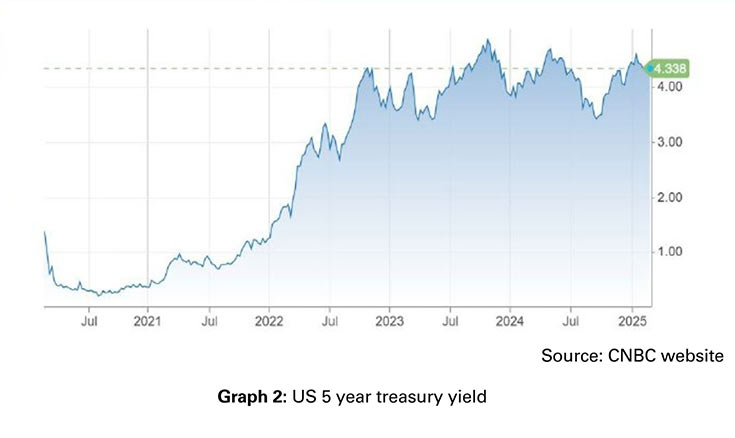

The general perception is that rising aircraft lease rates are solely driven by the imbalance between demand and supply. Although it cannot be denied that the demand/supply imbalance is a factor, the reality is that lessors require higher lease rates to offset their increased financing costs. Graph 2 illustrates clearly how financing costs have increased exponentially in recent years.

To put this into perspective, an analysis of major appraisers’ average market lease rates for five-year-old ATR 72-600 and Embraer E190-E1 aircraft as of January 2025 shows that they are 8% and 13%, respectively, below their levels in January 2020.

Clearly, market lease rates are still recovering from the rockbottom levels agreed during the COVID-19 pandemic. Over the same period, lessors’ debt financing costs have increased by approximately 20%.

Although, as EUROCONTROL noted, increased ticket prices, train/bus competition, government initiatives and environmental campaigns are all factors impacting regional aviation, there are sufficient signs of health in the sector in Europe. Operators of newer and larger regional aircraft are managing the consequences of supply chain constraints by supplementing capacity through lease extensions and the use of ACMI providers. As lessors, we now need them to accept that higher funding costs mean higher lease rates.

Download the full article as PDF

Download the full article as PDF

Article courtesy of Regional International

9 April 2025